Irs pay estimated taxes online 2021

Your browser appears to have cookies disabled. An estimated payment worksheet is available through your individual online services account to help you determine your estimated tax liability and how many payments you should make.

Fillable Form W 2 Or Wage And Tax Statement Edit Sign Download In Pdf Pdfrun Tax Forms Internal Revenue Service Fillable Forms

Payment for tax due on the 2021 MI-1040 Payment in response to a 2021 Proposed Tax Due letter sent to you by the Michigan Department of Treasury Michigan Estimated Income Tax for.

. Tax amounts for Tax Year 2021 are estimated and may be subject to. 100 of the tax shown on your 2021 return. Business make a payment pay pay Delaware taxes pay.

Tom Wolf Governor C. Make an Individual or Small Business Income Payment. The last day to pay is June 15th.

You can also pay your estimated tax online. You wont owe an estimated tax penalty if the tax shown on your 2022 return minus your 2022 withholding is less than 1000. Make a payment from your bank account or by debitcredit card.

Web Pay Make a payment online or schedule a future payment up to one year in advance go to ftbcagovpay for more. Income taxes are pay-as-you-go. Each payment of estimated tax must be accompanied by Form NC-40 North Carolina Individual Estimated Income Tax.

How do I pay my 2021 estimated taxes online. 2020 Tax Rate Increase for income. 425 57 votes The deadline for making a payment for the fourth quarter of 2021 is Tuesday January 18 2022.

To determine if these changes will affect your. If the due date falls on a national or state holiday Saturday or Sunday then. Make and View Payments.

You can also make a guest payment without logging in. Need assistance with making a payment. Payments are currently disabled.

15 of the following year. One notable exception is if the 15th falls on a. Estimated taxes are paid quarterly usually on the 15th day of April June September and January of the following year.

PROPERTY TAX Baldwin County Alabama. Individual Payment Type options include. The deadline to file and pay your 2021 estimated taxes has passed.

Realty Transfer Tax Payment. Estimated tax installment payments are due on. Visit Where can I get vaccinated or call 1-877-COVAXCO 1-877-268-2926 for vaccine information.

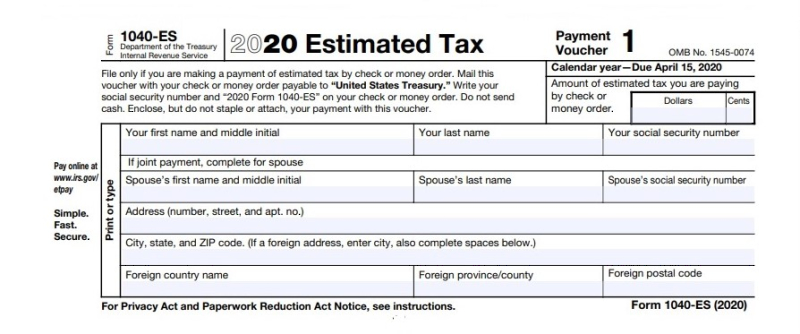

Please contact the Division of Revenue at 302 577-8785. View 5 years of. Use Form 1040-ES to figure and pay your estimated tax for 2022.

The 2021-2022 New York State budget replaced the highest personal income tax bracket and rate for 2021 with three new brackets and rates. If you estimate that you will owe more than 400 in New Jersey Income Tax at the end of the year you are required to make estimated payments. You cant pay your 2021 taxes online until after this date.

Estimated tax is the method used to pay tax on income that isnt subject to withholding for example earnings from self. Personal Income Tax Payment. Cookies are required to use this site.

If you dont pay. Contact Us 251 937-0245. This includes self-employment tax and the alternative minimum tax.

Aside from income tax taxpayers can pay other taxes through estimated tax payments.

Estimated Income Tax Payments For 2022 And 2023 Pay Online

Form 1040 Es Paying Estimated Taxes Jackson Hewitt

Irs Notice Cp17 Refund Of Excess Estimated Tax Payments H R Block

What Happens If You Miss A Quarterly Estimated Tax Payment White Coat Investor

What Is Irs Form 1040 Es Guide To Estimated Income Tax Bench Accounting

Estimated Tax Payments Youtube

What Does 11 Form Look Like What Does 11 Form Look Like Is So Famous But Why Tax Forms Irs Tax Forms Income Tax Return

How To Electronic Estimated Tax Payments To The Irs With Peace Of Mind Accounting Cpa Firm Minneapolis Tax Preparation Services St Paul Mn

When Is The Form 941 Due For 2021 Due Date Irs Forms Form

Making Electronic Estimated Tax Payments In California Robert Hall Associates

Quarterly Taxes 5 Quick Steps To Pay Estimated Tax Payments Online Careful Cents Estimated Tax Payments Quarterly Taxes Tax Payment

To Win At The Tax Game Know The Rules Published 2015 Income Tax Return Irs Tax Forms Tax Forms

Faqs On Penalty For Underpayment Of Estimated Tax Https Www Irstaxapp Com Faqs On Penalty For Underpayment Of Estimated Tax Tax Tax Deductions Coding

How To Pay Federal Estimated Taxes Online To The Irs In 2022 Estimated Tax Payments Online Taxes Tax Help

What Is Irs Form 1040 Es Guide To Estimated Income Tax Bench Accounting

How To Pay Your Estimated Taxes Online With The Irs Quarterly Taxes Youtube

How To Make The 2 Estimated Tax Payments Also Due July 15 Don T Mess With Taxes